No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Kiplinger recognized the Buffalo Small Cap and the Buffalo International Funds as “Top-Performing Mutual Funds” in their recent fund analysis for the period ending October 31, 2019.

The Buffalo Small Cap Fund (BUFSX) ranked #3 in the Small-Company Stock Funds category for 20-year annualized returns, and the Buffalo International Fund (NASDAQ: BUFIX) ranked #10 in the International Diversified Large-Company Funds category for 5-year annualized returns.

Management Teams:

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Stay up-to-date with the most recent media coverage and press releases about the Buffalo Funds.

Buffalo International Fund co-portfolio manager Nicole Kornitzer, CFA, was recently interviewed by Barron’s about the parallels she finds in gourmet cooking and international investing. In the article, she describes the team’s approach to picking premier growth stocks based on in-depth analysis of company fundamentals and highlights the team’s long-term investment philosophy that focuses less on short-term market movements.

“We need to be able to answer the question of why is the company going to continue growing.“

~ Nicole Kornitzer, CFA

Nicole also discusses several foreign large-cap stocks in the BUFIX/BUIIX portfolio which illustrate the Fund’s investment process in action:

Opinions expressed are those of the author or Funds and are subject to change, are not intended to be a forecast of future events, a guarantee of future results, nor investment advice. References to other mutual funds should not to be considered an offer to buy or sell these securities. A complete list of the Fund’s holdings can be found here. Fund holdings are subject to change and should not be considered a recommendation to buy or sell any security.

Annualized Performance (%)

| As of 3/31/25 | 3 MO | YTD | 1 YR | 3 YR | 5 YR | 10 YR | Since Inception |

|---|---|---|---|---|---|---|---|

| BUFFALO INTERNATIONAL FUND - Investor | 5.10 | 5.10 | -2.19 | 2.67 | 10.87 | 7.16 | 5.32 |

| BUFFALO INTERNATIONAL FUND - Institutional | 5.20 | 5.20 | -2.01 | 2.83 | 11.05 | 7.32 | 5.48 |

| FTSE All World Ex-US Index | 5.05 | 5.05 | 6.65 | 4.98 | 11.67 | 5.62 | 3.40 |

| Lipper International Fund Index | 6.66 | 6.66 | 6.22 | 6.06 | 12.38 | 5.72 | 3.50 |

The expense ratio for BUIIX is 0.91% and 1.06% for BUFTX. Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower of higher than the performance quoted and can be found here; quarter-end performance can be found here. Performance is annualized for periods greater than 1 year.

Nicole Kornitzer, Buffalo International Fund co-portfolio manager, discusses her team’s approach to finding premier growth companies that are poised to take advantage of global trends.

Joel Crampton

Director of Marketing

(913) 647-9881

Kiplinger recognized the Buffalo Flexible Income and International Funds as “Top-Performing Mutual Funds” in their recent fund analysis.

Kiplinger recognized the Buffalo Flexible Income and International Funds as “Top-Performing Mutual Funds” in their recent fund analysis.

Kiplinger recognized the Buffalo Flexible Income, International, and Small Cap Funds as “Top-Performing Mutual Funds” in their recent fund analysis.

Kiplinger recognized the Buffalo International and Flexible Income Funds as “Top-Performing Mutual Funds” in their recent fund analysis.

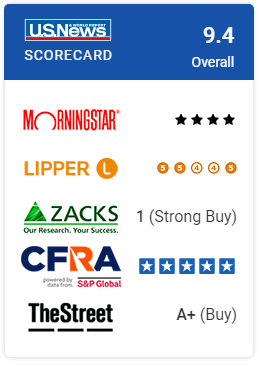

U.S. News & World Report recognized the Buffalo International Fund in their recent “Best Mutual Funds” fund analysis for the period ending July 31, 2019.

The Buffalo International Fund (NASDAQ: BUFIX) ranked #2 out of 470 Foreign Large Growth funds based on the overall equal weightings of ratings from 5 data sources – Morningstar, Lipper, Zacks, CFRA S&P, TheStreet.

Management Team:

Performance quoted by US News may not be current. For current quarter-end standardized performance and disclosure information, please click here.

Current U.S. News ranking and additional information can be found here https://money.usnews.com/funds/mutual-funds/foreign-large-growth/buffalo-international-fund/bufix . The Overall Morningstar Rating™ for a managed product is derived from a weighted average of the performance figures associated with its 3-, 5-, and 10-year (if applicable) Morningstar Rating™ metrics. While the U.S. News Mutual Fund Score combines all 5 equally weighted category scores to achieve its weighting, Lipper intends its measures to be used as individual assessments of a fund’s ability to meet specific goals, rather than as a cumulative measure of fund quality. Lipper rankings are comprised of five unique measures (Total Return, Consistent Return, Preservation, Expense, and Tax Efficiency), each with a 1-to-5 score, ranking each fund against its peers. The highest 20% of funds in each peer group are named Lipper Leaders, the next 20% receive a rating of 4, the middle 20% are rated 3, the next 20% are rated 2, and the lowest 20% are rated 1. The overall calculation is based on an equal-weighted average of percentile ranks for each measure over 3-, 5-, and 10-year periods (if applicable). Lipper Ratings for Total Return reflect funds’ historical total return performance relative to peers. Lipper Ratings for Consistent Return reflect funds’ historical risk-adjusted returns, relative to peers. Lipper Ratings for Preservation reflect funds’ historical loss avoidance relative to other funds within the same asset class. Lipper Ratings for Tax Efficiency reflect funds’ historical success in postponing taxable distributions relative to peers. Lipper Ratings for Expense reflect funds’ expense minimization relative to peers with similar load structures. The Zacks Mutual Fund Rank ranks funds on a scale from 1 to 5, with 1 being a Strong Buy and 5 being a Strong Sell. Each quarter, Zacks updates their Mutual Fund Rank by evaluating the average Zacks Rank for the stocks owned by the fund and blending this with other criteria their studies show is beneficial in finding funds that will outperform in the future. In general, the higher the average Zacks Rank for the stocks in the fund, then the higher the Zacks Mutual Fund Rank. TheStreet.com Ratings Investment Ratings for Funds condense the available fund performance and risk data into a single composite opinion of each fund’s risk-adjusted performance. “A (Buy) Excellent” rating means the fund has an excellent track record of maximizing performance while minimizing risk, thus delivering the best possible combination of total return on investment and reduced volatility. “B (Buy) Good” rating means the fund has a good track record of balancing performance with risk. “C (Hold) Fair” rating ratings means the fund has a track record which is about average. “D (Sell) Weak” rating means the fund has underperformed the universe of other funds given the level of risk in its underlying investments, resulting in a weak risk-adjusted performance. “E (Sell) Very Weak” rating means the fund has significantly underperformed most other funds given the level of risk in its underlying investments, resulting in a very weak risk-adjusted performance. The plus sign (+) is an indication that the fund is in the top third of its letter grade. The minus sign (-) is an indication that the fund is in the bottom third of its letter grade. “U Unrated” rating means the fund does not have sufficient history to make a reliable assessment of its risk-adjusted performance. The CFRA Rankings range from five-star (highest) to one-star (lowest) and follow a normalized distribution curve, based upon the fund’s rank in its Category. Top 10% receive 5 stars, next 20% receive 4 stars, middle 40% receive 3 stars, next 20% receive 2 stars, and the bottom 10% receive 1 star. Rankings are refreshed on a weekly basis to incorporate the latest inputs from the holdings-based analysis and the latest relative performance review. The Morningstar Rating™ for funds, or “star rating”, is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating™ for a managed product is derived from a weighted average of the performance figures associated with its 3-, 5-, and 10-year (if applicable) Morningstar Rating™ metrics. The weights are: 100% 3-year rating for 36-59 months of total returns, 60% 5-year rating/40% 3-year rating for 60-119 months of total returns, and 50% 10-year rating/30% 5-year rating/20% 3-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent 3-year period actually has the greatest impact because it is included in all 3 rating periods. ©2019 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Stay up-to-date with the most recent media coverage and press releases about the Buffalo Funds.

Buffalo Funds International co-portfolio manager Nicole Kornitzer, CFA, was recently interviewed by MarketWatch about her team’s top-down strategy of focusing on secular growth trends. She goes in-depth to discuss two trends around health care — “cost containment and increasing consumption as the middle class quickly expands in developing countries and as populations age”. She also provided several examples of European companies within the Fund’s portfolio that highlight their investment strategy at work:

|

“The concern about health-care pricing is not limited to U.S. companies, it is a concern for all companies around the world that sell in the U.S. market.“ ~ Nicole Kornitzer, CFA, Co-Portfolio Manager, Buffalo International Fund |

To access the MarketWatch article click here.

During an interview with MarketWatch, Nicole Kornitzer, CFA, (Buffalo International Fund co-portfolio manager) described her team’s top-down strategy when studying secular growth trends within the health care industry and identifies 3 companies which are well-positioned to benefit from these long-term trends.

Joel Crampton

Director of Marketing

(913) 647-9881

Opinions expressed are those of the author or Funds as of 6/27/19 and are subject to change, are not intended to be a forecast of future events, a guarantee of future results, nor investment advice. Past performance does not guarantee future results. References to other mutual funds should not to be considered an offer to buy or sell these securities. A complete list of the Fund’s holdings can be found here. Fund holdings are subject to change and should not be considered a recommendation to buy or sell any security. Earnings growth is not representative of the Fund’s future performance. All charts provided by MarketWatch.

4 star Overall Morningstar Rating™ of BUFIX based on risk-adjusted returns among 396 Foreign Large Growth funds as of 6/30/19. The Morningstar Rating™ for funds, or “star rating”, is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating™ for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating™ metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. The Buffalo International Fund (BUFIX) received 5 stars among 396 for the 3-year, 4 stars among 336 for the 5-year, and 4 stars among 247 Foreign Large Growth funds for the 10-year period ending 6/30/19. In each Morningstar Category, the 10% of funds with the lowest measured risk are described as Low Risk, the next 22.5% Below Average, the middle 35% Average, the next 22.5% Above Average, and the top 10% High. Morningstar Risk is measured for up to three time periods (three, five, and 10 years). These separate measures are then weighted and averaged to produce an overall measure for the fund. Funds with less than three years of performance history are not rated. ©2019 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. The Morningstar Style Box™ reveals a fund’s investment strategy by showing its investment style and market capitalization based on the fund’s portfolio holdings.

Stay up-to-date with the most recent media coverage and press releases about the Buffalo Funds.

“International equities appear ready to take a leadership role, and the international market cycle has a long recovery ahead.”

Based on a multitude of global market factors, including cheaper valuations in international stocks and an accommodative credit cycle in global markets, we believe now is the time for investors to rethink international equity exposure and consider increasing international stock allocations.

However, due to a lack of insight and a bias towards domestic U.S. stocks, many investors only allocate a minimal exposure to the international equities asset class when devising an investment plan.

In this report, we provide insights into several areas that show the potential for increasing returns of international stocks over the long term:

|

|

Bill Kornitzer, CFA, has 26 years of professional investment experience, including portfolio management of the Buffalo International Fund (BUFIX) since the Fund’s inception in 2007.

Opinions expressed are those of the author or Funds and are subject to change, are not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

We get to know the companies we invest in and learn how they run their business.

We identify Top-Down broad, secular growth trends and search for companies from the Bottom-Up.

We construct our portfolios based on our own proprietary investment strategy.

Sticking to our disciplined investment strategy ensures we maintain a consistent, balanced approach.

Buffalo Funds International co-portfolio manager Bill Kornitzer, CFA, was recently interviewed by The Wall Street Transcript about the ongoing trade war rhetoric and how they might impact the International Fund. He also provides insights into the importance of investing internationally and cites several examples of companies within his portfolio that highlight his team’s investment strategy at work:

“While they’re not immune from the turbulence caused by these changing tariff regimes, our process naturally pushes us away from heavily cyclical and commodity-oriented type companies, which are frequently the direct point of trade actions and where the real issue could be on a company-specific basis.“ ~ Bill Kornitzer, CFA, Co-Portfolio Manager, Buffalo International Fund

To access The Wall Street Transcript article click here.

Diversification does not assure a profit, nor does it protect against a loss in a declining market.

Opinions expressed are those of the author or Funds as of 7/30/18 and are subject to change, are not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Past performance does not guarantee future results.

References to other mutual funds should not to be considered an offer to buy or sell these securities.

A complete list of the Fund’s holdings can be found here. Fund holdings are subject to change and should not be considered a recommendation to buy or sell any security.

Earnings growth is not representative of the fund’s future performance.

WTO stands for World Trade Organization. FDA stands for Food & Drug Administration. Cash flow is a measure of the cash produced by the firm in a given period on behalf of equity holders. The true measure of the value of a firm’s equity is considered to be the present value of all free cash flows. Tier-1 capital ratio is the ratio of a bank’s core equity capital to its total risk-weighted assets (RWA). Risk-weighted assets are the total of all assets held by the bank weighted by credit risk according to a formula determined by the regulator (usually the country’s central bank). ROE stands for return on equity and is the amount of net income returned as a percentage of shareholders’ equity. The book value of a company is the total value of the company’s assets, minus the company’s outstanding liabilities. GDP stands for gross domestic product.

All charts provided by The Wall Street Transcript.

Bill Kornitzer, BUFIX co-portfolio manager, discusses the accelerated pace of the growth of global economies outside the U.S. and why, given where valuations are today, there are many opportunities to invest internationally at this time.

Joel Crampton

Director of Marketing

(913) 647-9881

Stay up-to-date with the most recent media coverage and press releases about the Buffalo Funds.