Flexible Allocation Fund

Quick Facts

| Investor | Institutional | |

| Ticker: | BUFBX | BUIBX |

| Daily Pricing: | ||

| As of 6/9/2025 | ||

| NAV: | $20.85 | $20.84 |

| $ Change: | $-0.01 | $-0.01 |

| % Change: |

-0.05% | -0.05% |

| YTD: |

3.78% | 3.85% |

| Inception Date: | 8/12/1994 | 7/1/2019 |

| Expense Ratio: | 1.01% | 0.86% |

| Total Net Assets: | $467.55 Million (3/31/25) | |

| Morningstar Category: | Large Value | |

| Benchmark Index: | Russell 3000 | |

| Dividend Distribution: | Monthly | |

|

Related Material: Fund Fact Sheet Q1 2025 PM Commentary Q1 2025 |

||

Fund Objective & Investment Process

The investment objective of the Buffalo Flexible Allocation Fund is primarily the generation of high current income and, as a secondary objective, the long-term growth of capital. To pursue its investment objectives, the Flexible Allocation Fund invests in both debt and equity securities.

The allocation of assets invested in each type of security is designed to balance income and long-term capital appreciation with reduced volatility of returns. The Flexible Income Fund expects to change its allocation mix over time based on the Fund managers’ view of economic conditions and underlying security values.

The Fund maintains a flexible investment policy which allows it to invest in debt securities with varying maturities. However, it is anticipated that the dollar-weighted average maturity of debt securities that the Fund purchases will not exceed 15 years.

▼John Kornitzer, Portfolio Manager

Morningstar Rating

Overall Morningstar Rating™ of BUFBX based on risk-adjusted returns among 1,092 Large Value funds as of 3/31/25.

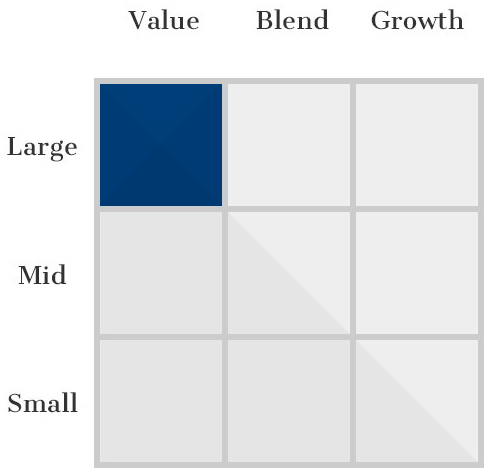

Investment Style

Performance (%)

| As of 4/30/25 | 3 MO | YTD | 1 YR | 3 YR | 5 YR | 10 YR | 15 YR | 20 YR | Since Inception |

|---|---|---|---|---|---|---|---|---|---|

| BUFFALO FLEXIBLE ALLOCATION FUND - Investor | -2.25 | 0.30 | 3.53 | 6.78 | 12.85 | 7.50 | 8.27 | 7.66 | 7.53 |

| BUFFALO FLEXIBLE ALLOCATION FUND - Institutional | -2.21 | 0.35 | 3.69 | 6.92 | 13.01 | 7.60 | 8.33 | 7.71 | 9.16 |

| Russell 3000 Index | -8.26 | -5.36 | 11.40 | 11.41 | 15.12 | 11.68 | 12.55 | 10.16 | 10.37 |

| Lipper Mixed-Asset Target Allocation Moderate Funds Index | -2.18 | 0.02 | 8.48 | 6.40 | 8.06 | 5.97 | 6.77 | 6.01 | 6.82 |

| As of 3/31/25 | 3 MO | YTD | 1 YR | 3 YR | 5 YR | 10 YR | 15 YR | 20 YR | Since Inception |

|---|---|---|---|---|---|---|---|---|---|

| BUFFALO FLEXIBLE ALLOCATION FUND - Investor | 4.97 | 4.97 | 5.17 | 7.56 | 16.78 | 8.18 | 8.71 | 7.83 | 7.71 |

| BUFFALO FLEXIBLE ALLOCATION FUND - Institutional | 5.01 | 5.01 | 5.28 | 7.70 | 16.94 | 8.34 | 8.87 | 7.99 | 7.87 |

| Russell 3000 Index | -4.72 | -4.72 | 7.22 | 8.22 | 18.18 | 11.80 | 12.76 | 10.08 | 10.42 |

| Lipper Mixed-Asset Target Allocation Moderate Funds Index | 0.19 | 0.19 | 5.43 | 4.43 | 9.55 | 6.09 | 6.87 | 5.97 | 6.85 |

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BUFFALO FLEXIBLE ALLOCATION FUND - Investor | 16.68 | 3.59 | -1.97 | 9.90 | 13.21 | -7.00 | 18.76 | -2.24 | 30.00 | 4.01 | 7.43 | 10.26 |

| BUFFALO FLEXIBLE ALLOCATION FUND - Institutional | 16.85 | 3.75 | -1.83 | 10.07 | 13.38 | -6.86 | 18.87 | -2.10 | 30.21 | 4.22 | 7.53 | 10.43 |

| Russell 3000 Index | 33.55 | 12.56 | 0.48 | 12.74 | 21.13 | -5.24 | 31.02 | 20.89 | 25.66 | -19.21 | 25.96 | 23.81 |

Hypothetical Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund on the Fund’s inception date. Assumes reinvestment of dividends and capital gains. This chart does not imply future performance.

Distributions

| Record Date | Payable Date | Distribution NAV | Net Investment Income | Short-Term Capital Gains | Long-Term Capital Gains | Distribution Total |

|---|---|---|---|---|---|---|

| 12/17/2024 | 12/18/2024 | $20.12(Inv) $20.11 (Inst) | 0.06759021 0.06984328 | - - | - - | 0.06759021 0.06984328 |

| 12/04/2024 | 12/05/2024 | $21.32(Inv) $21.31 (Inst) | - - | 0.01365 0.01365 | 0.43488 0.43488 | 0.448530 0.448530 |

| 11/18/2024 | 11/19/2024 | $21.28(Inv) $21.28 (Inst) | 0.02720661 0.03003258 | - - | - - | 0.02720661 0.03003258 |

| 10/17/2024 | 10/18/2024 | $21.63(Inv) $21.63 (Inst) | 0.01411760 0.01678565 | - - | - - | 0.01411760 0.01678565 |

| 9/17/2024 | 9/18/2024 | $21.41(Inv) $21.40 (Inst) | 0.03360563 0.09380152 | - - | - - | 0.03360563 0.09380152 |

| 8/19/2024 | 8/20/2024 | $21.18(Inv) $21.17 (Inst) | 0.04875717 0.05161794 | - - | - - | 0.04875717 0.05161794 |

| 7/17/2024 | 7/18/2024 | $21.31(Inv) $21.30 (Inst) | 0.00001602 0.00260696 | - - | - - | 0.00001602 0.00260696 |

| 6/17/2024 | 6/18/2024 | $20.75(Inv) $20.74 (Inst) | 0.02888410 0.03152106 | - - | - - | 0.02888410 0.03152106 |

| 5/17/2024 | 5/20/2024 | $20.87(Inv) $20.87 (Inst) | 0.04860370 0.05114302 | - - | - - | 0.04860370 0.05114302 |

| 4/17/2024 | 4/18/2024 | $20.15(Inv) $20.14 (Inst) | 0.00702538 0.00958157 | - - | - - | 0.00702538 0.00958157 |

| 3/18/2024 | 3/19/2024 | $20.52(Inv) $20.51 (Inst) | 0.00271906 0.00495243 | - - | - - | 0.00271906 0.00495243 |

| 2/20/2024 | 2/21/2024 | $19.85(Inv) $19.85 (Inst) | 0.01198410 0.01472364 | - - | - - | 0.01198410 0.01472364 |

| 1/17/2024 | 1/18/2024 | $19.02 (Inv) $19.02 (Inst) | 0.02220238 0.02456864 | - - | - - | 0.02220238 0.02456864 |

Portfolio

Portfolio Characteristics

| (As of 3/31/25) | |

|---|---|

| # of Holdings | 44 |

| Median Market Cap | $93.45 B |

| Weighted Average Market Cap | $433.09 B |

| 3-Yr Annualized Turnover Ratio | 0.83% |

| 30-day SEC Yield | 1.72% |

Top 10 Holdings

| Holding | Ticker / Maturity | Sector | % of Net Assets |

|---|---|---|---|

| Microsoft Corporation | MSFT | Information Technology | 9.90 |

| Eli Lilly and Company | LLY | Health Care | 5.87 |

| Costco Wholesale Corporation | COST | Consumer Staples | 4.98 |

| Arthur J. Gallagher & Co. | AJG | Financials | 4.01 |

| Chevron Corporation | CVX | Energy | 3.94 |

| Exxon Mobil Corporation | XOM | Energy | 3.86 |

| Allstate Corporation | ALL | Financials | 3.77 |

| Hess Corporation | HES | Energy | 3.61 |

| International Business Machines Corporation | IBM | Information Technology | 3.35 |

| Kinder Morgan, Inc. | KMI | Energy | 3.34 |

| TOP 10 HOLDINGS TOTAL | 46.62% | ||

Sector Weighting

As of 3/31/25. Security weightings are subject to change and are not recommendations to buy or sell any securities. Sector Allocation may not equal 100% due to rounding.

Asset Allocation

As of 3/31/25. Allocation percentages may not equal 100% due to rounding.

Management

Commentary

Literature

| Buffalo Flexible Allocation Fund Documents | Last Updated |

|---|---|

| Fact Sheet | 3/31/25 |

| Quarterly Commentary | 3/31/25 |

| Full Fund Holdings | 12/31/24 |

| Prospectus | 7/29/24 |

| Statement of Additional Information | 7/29/24 |

| Annual Report | 3/31/24 |

| Semi-Annual Report | 9/30/23 |

| Tax Guide - 2023 | 1/8/24 |

Fundamental Approach

We get to know the companies we invest in and learn how they run their business.

Top-Down & Bottom-Up

We identify Top-Down broad, secular growth trends and search for companies from the Bottom-Up.

Proprietary Philosophy

We construct our portfolios based on our own proprietary investment strategy.

Disciplined Investing

Sticking to our disciplined investment strategy ensures we maintain a consistent, balanced approach.

The Morningstar Rating™ for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating™ for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating™ metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

The Buffalo Flexible Allocation Fund (BUFBX) received 4 stars among 1092 for the 3-year, 4 stars among 1030 for the 5-year, and 3 stars among 808 Large Value funds for the 10-year period ending 3/31/25.